Furnished holiday lettings and tax

The UK has very favourable Inheritance Tax (IHT) treatment for the owners of business assets used in a trade and, in general, the value of these will be outside the charge to IHT on death provided certain criteria are met.

The IHT relief available on business assets is called Business Property Relief (BPR), or Agricultural Property Relief in the case of agricultural assets. It is only available for assets used in a trade, not those used to generate investment income, such as the letting of land.

There is a clear grey area, however, when it comes to the provision of furnished holiday lettings (FHLs), as these are subject to a special tax regime. For capital gains tax purposes they qualify for Entrepreneurs’ Relief, Business Asset Rollover Relief and other reliefs. For income tax purposes, capital allowances can be claimed and the earnings qualify as earnings against which pension payments can be treated as a tax deduction.

HM Revenue and Customs (HMRC) have an advice page on FHLs here. Interestingly, this talks little about the level of services that must be provided for lettings to qualify as FHLs;even though the level of services provided is the criterion that HMRC use to claim that lettings of property do not qualify for the reliefs available for FHLs.

In the case of Re. the Estate of Marjorie Ross [2017], HMRC contested a claim that a property worth more than £1 million was an FHL that was eligible for BPR and thus excluded from the estate of a deceased woman partner in the business for IHT purposes. The property concerned consisted of a number of self-catering cottages, the rental terms of which included several features and services which are not frequently found in mere lettings.

HMRC contended that the business was primarily one of the letting of land and that it should not be;treated as anything other than a business investing in land with ancillary services;the essence of the activity remains the exploitation of land in return for rent. HMRC made a point of commenting on the business profits, which had been low for many years, compared with the capital gain, which was in the order of £1 million.

The First-tier Tribunal did not accept that the provision of the additional services, which were supplied directly by the partnership or by an adjacent hotel, made the properties FHLs.

The case is important reading for those considering going into the FHL business or those engaged in holiday letting. There is no doubt that HMRC are upping their efforts to increase the tax yields from IHT.

[edit] Related articles on Designing Buildings Wiki

Featured articles and news

One of the most impressive Victorian architects. Book review.

RTPI leader to become new CIOB Chief Executive Officer

Dr Victoria Hills MRTPI, FICE to take over after Caroline Gumble’s departure.

Social and affordable housing, a long term plan for delivery

The “Delivering a Decade of Renewal for Social and Affordable Housing” strategy sets out future path.

A change to adoptive architecture

Effects of global weather warming on architectural detailing, material choice and human interaction.

The proposed publicly owned and backed subsidiary of Homes England, to facilitate new homes.

How big is the problem and what can we do to mitigate the effects?

Overheating guidance and tools for building designers

A number of cool guides to help with the heat.

The UK's Modern Industrial Strategy: A 10 year plan

Previous consultation criticism, current key elements and general support with some persisting reservations.

Building Safety Regulator reforms

New roles, new staff and a new fast track service pave the way for a single construction regulator.

Architectural Technologist CPDs and Communications

CIAT CPD… and how you can do it!

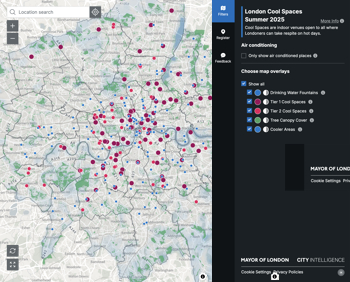

Cooling centres and cool spaces

Managing extreme heat in cities by directing the public to places for heat stress relief and water sources.

Winter gardens: A brief history and warm variations

Extending the season with glass in different forms and terms.

Restoring Great Yarmouth's Winter Gardens

Transforming one of the least sustainable constructions imaginable.

Construction Skills Mission Board launch sector drive

Newly formed government and industry collaboration set strategy for recruiting an additional 100,000 construction workers a year.

New Architects Code comes into effect in September 2025

ARB Architects Code of Conduct and Practice available with ongoing consultation regarding guidance.

Welsh Skills Body (Medr) launches ambitious plan

The new skills body brings together funding and regulation of tertiary education and research for the devolved nation.

Paul Gandy FCIOB announced as next CIOB President

Former Tilbury Douglas CEO takes helm.